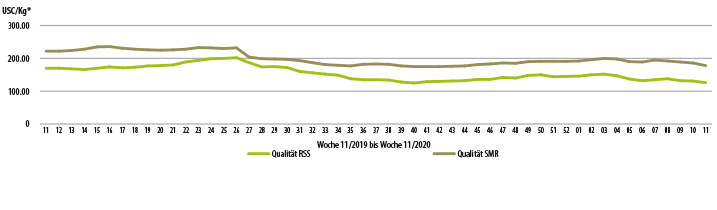

The increase in rubber prices of up to 13 percent observed during the previous period disappeared again in this reporting period. However, compared with the price corrections on the stock exchange and financial markets in recent weeks, where such setbacks were sometimes recorded on a single day, the rubber price has done rather well. Nevertheless, at USD 1.25 to 1.78 (depending on quality), it is problematically low for many producers. The corona virus, especially the many uncertainties about what the economic (and social) consequences will be, severely paralysed trade and markets from mid-February onwards. The factors that otherwise dominate at this time of year, which influence the market and price, namely the wintering phase in the major rubber producing countries and the Chinese New Year (officially: 25 January to 8 February 2020), have tended to play a minor role this year. The fact that the measures taken by the Chinese government against the spread of the corona virus led to a veritable standstill of large parts of industrial production for weeks, triggered a worldwide domino effect culminating in supply shortfalls on the one hand and hamster purchases on the other. The bottom line is that there has been a tendency to oversupply rubber in recent weeks. The resulting negative impact on rubber prices was additionally fuelled by the massive drop in oil prices in the second week of March. Since synthetic rubber is made from a by-product of oil (butadiene), lower oil prices mean lower synthetic rubber prices. This in turn increases the pressure on natural rubber prices. Nevertheless, now that the first signs of recovery are emerging from China, industry insiders believe that the current lethargy in trade and markets will not only soon be resolved as the corona crisis begins to unwind, but may even turn into the opposite, if instead of congestion and uncertainty in the markets, pent-up demand and confidence returns.

<!--31

18.03.2020 - View Newsletter Q1-2-2020 (currently available in German only)